Employee benefits packages designed to fit your needs and drive employee engagement.

Let us conduct a benefits audit with you to help you identify the right employee benefits plan.

BKCW AMPLIFIES LOYALTY

A robust employee benefits package can make a huge difference in your business. Solid employee benefits increase loyalty, drive employee engagement, and encourage workers to stay with your company.

LINES OF COVERAGE

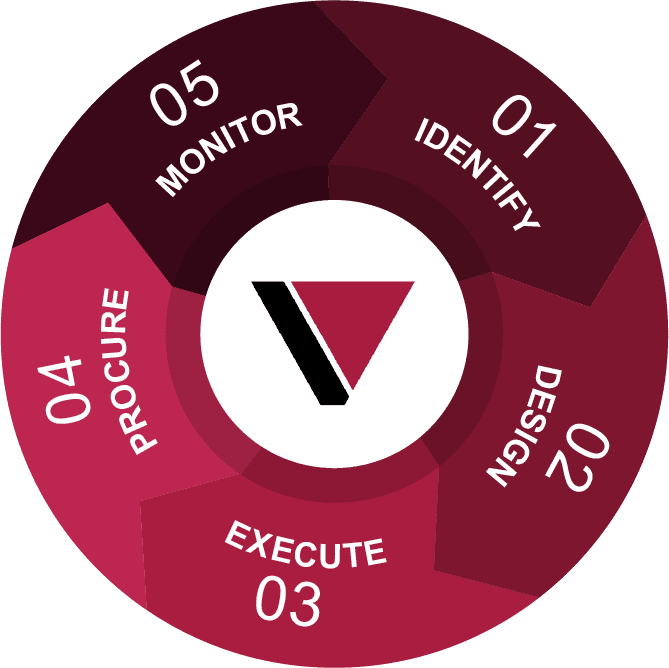

OUR PROCESS

Identify

• Employee Interviews

• Claims Analysis

• Employee Handbook Review

• Claims Analysis

• Employee Handbook Review

Design

• Health Risk Monetization

• Practices & Procedures

• Practices & Procedures

Execute

• Wellness Programs

• Claims Management

• Claims Management

Procure

• Marketing

Monitor

• Claims Reviews

• Pre-Renewal Strategy Sessions

• HR & Employment Practices Audits

• Stewardship Review

• Pre-Renewal Strategy Sessions

• HR & Employment Practices Audits

• Stewardship Review