Risk Management that goes beyond policy quotes.

Let us conduct a free risk audit for you to help you identify your weak spots.

BKCW MEANS BUSINESS

When it comes to protecting your livelihood, our consultants take the time to learn what makes you and your business tick. We strive to know your business as well as we know ours, and by the end of our process, we become an extension of your team.

Does This Look Familiar?

The Insurance Trap

Escape the Insurance Trap with

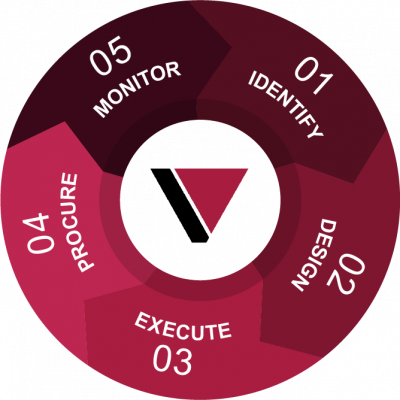

The PIVOT Risk Management process is how we help you escape from the Insurance Trap. We begin with a risk management audit, then we help you design strategies to mitigate risk, and execute those strategies. Lastly, we procure insurance and help monitor your situation.

LINES OF COVERAGE